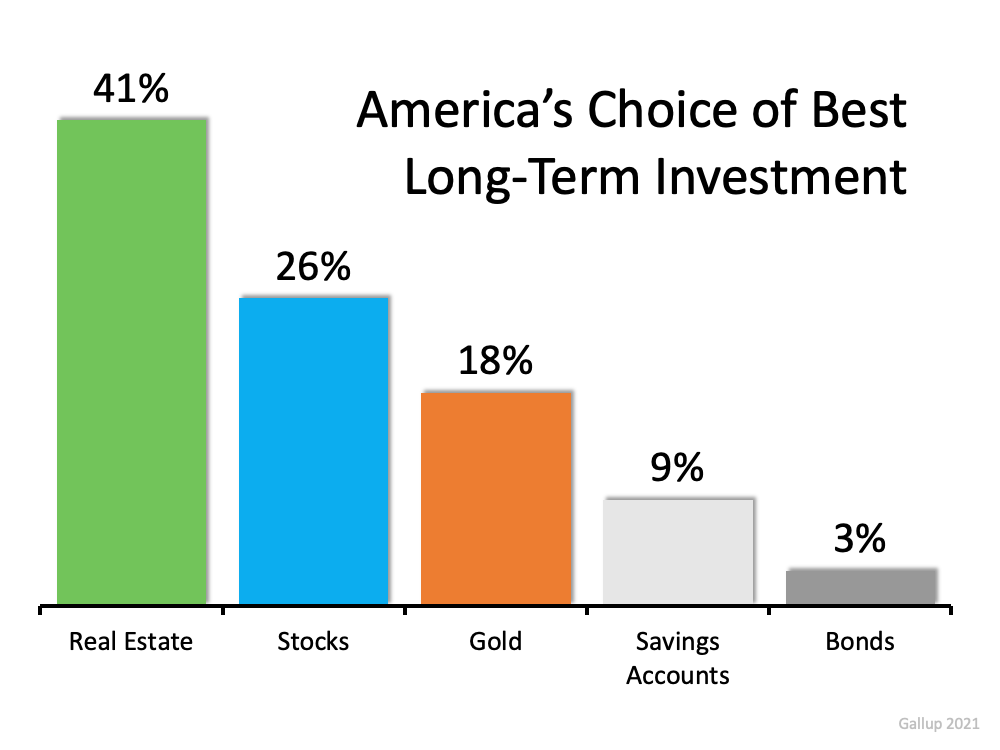

Last month, in a post on the Liberty Street Economics blog, the Federal Reserve Bank of New York noted that Americans believe buying a home is definitely or probably a better investment than buying stocks. Last week, a Gallup Poll reaffirmed those findings.

In an article on the current real estate market, Gallup reports:

“Gallup usually finds that Americans regard real estate as the best long-term investment among several options — seeing it as superior to stocks, gold, savings accounts and bonds. This year, 41% choose real estate as the best investment, up from 35% a year ago, with stocks a distant second.”

Here’s the breakdown: The article goes on to say:

The article goes on to say:

“The 41% choosing real estate is the highest selecting any of the five investment options in the 11 years Gallup has asked this question.”

Is real estate really a secure investment right now?

Some question American confidence in real estate as a good long-term investment right now. They fear that the build-up in home values may be mirroring what happened right before the housing crash a little more than a decade ago. However, according to Merrill Lynch, J.P. Morgan, Morgan Stanley, and Goldman Sachs, the current real estate market is strong and sustainable.

As Morgan Stanley explains to their clients in a recent Thoughts on the Market podcast:

“Unlike 15 years ago, the euphoria in today’s home prices comes down to the simple logic of supply and demand. And we at Morgan Stanley conclude that this time the sector is on a sustainably, sturdy foundation . . . . This robust demand and highly challenged supply, along with tight mortgage lending standards, may continue to bode well for home prices. Higher interest rates and post pandemic moves could likely slow the pace of appreciation, but the upward trajectory remains very much on course.”

Bottom Line

America’s belief in the long-term investment value of homeownership has been, is, and will always be, very strong.

You might also enjoy reading…