In an email, Gilbert Public Schools Board President Staci Burk said that, while she is normally not supportive of corporate tax breaks, she will be voting in support of the tax break, clearing the road for Apple to move to the vacant and never-used First Solar plant at Signal Butte and Elliot.

The school board was split Wednesday night, with Burk as the swing vote, but was left without a final vote after the district attorney noted that the meeting was in violation of open meeting laws requiring 24 hour notice of the meeting. A full vote will be taken Monday, with Burk calling in telephonically due to her being out of town for personal reasons.

In her email, Burk said, “After a thorough evaluation of this project, I believe that the economic benefit of having this firm as an integral part of the GPS community far outweighs any potential drawbacks. I have assured this firm of my support of the proposal moving forward which contains a hold harmless clause in favor the District. The associates have provided me with assurance that this project will continue to move forward as planned once the board vote is formalized on Monday.”

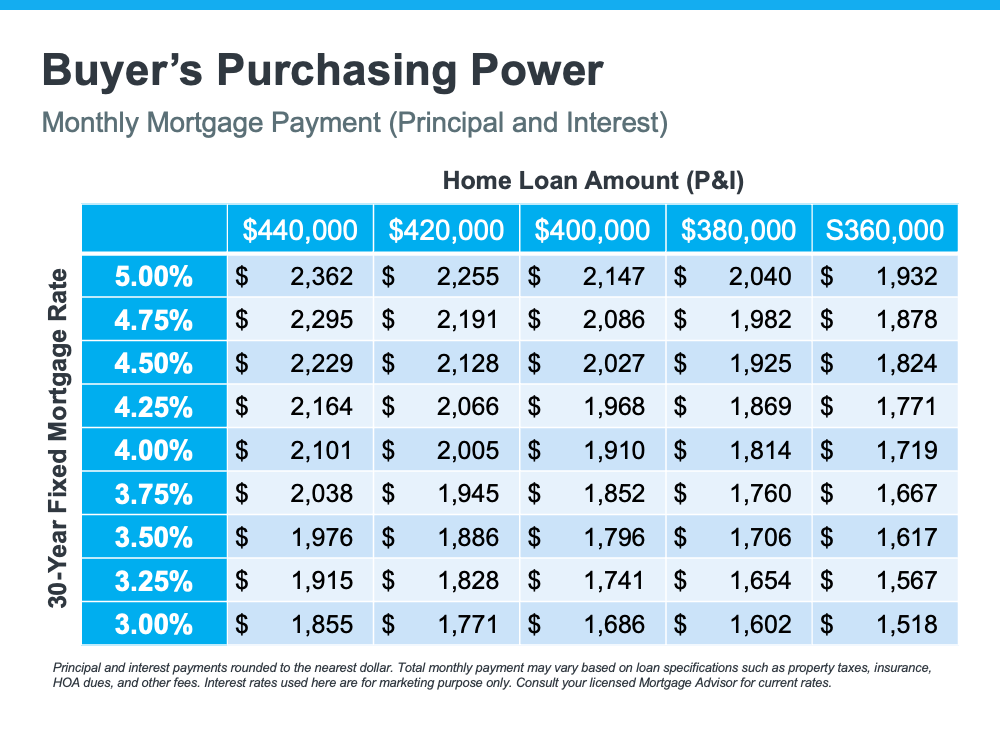

The issue had come down to a tax break given to Apple. As a part of negotiations, Apple had asked that the $79 million property be labeled a foreign trade zone for the sake of property taxation. Currently, taxation on the $79 million property without the improvements Apple would make would be 19.5%.

However, Apple plans to put about $1 billion in improvements into the property. Under the proposed tax break, the tax rate on the more valuable property would be 5%. Even with the reduced taxation, the Apple plant would result in at least $1 million in property taxes to the district.

In a meeting on Wednesday, November 13, the Gilbert School Board argued over whether to approve this tax break. As one of eight government agencies who would benefit from any taxation there, the GPS board would need to approve of the tax arrangement for it to take place. Seven other government entitites, Maricopa County, Mesa Community College, Maricopa Community Colleges, Central Arizona Project, Maricopa Integrated Health System, East Valley Institute of Technology and Mesa — have already approved the break.

City of Mesa Director of Economic Development Bill Jabjiniak said, “All the other entities looked at it as a big boon. This is a win/win for everybody involved. These are opportunities that we get every so often. … You’re not going to get another crack at this.”

Without the tax break, Apple could pull out of the sale and relocate to another site, most likely outside of Arizona.

Two board members were adamantly supportive, and two were adamantly opposed. With Burk’s positive vote, the measure should pass, assuming the other members do not change their votes.

The Gilbert Public Schools Board Members are:

Staci Burk, President

Julie Smith, Clerk

Daryl Colvin, Member

Jill Humpherys, Member

Lily Tram, Member