Take advantage of opportunities to fix your housing payments.

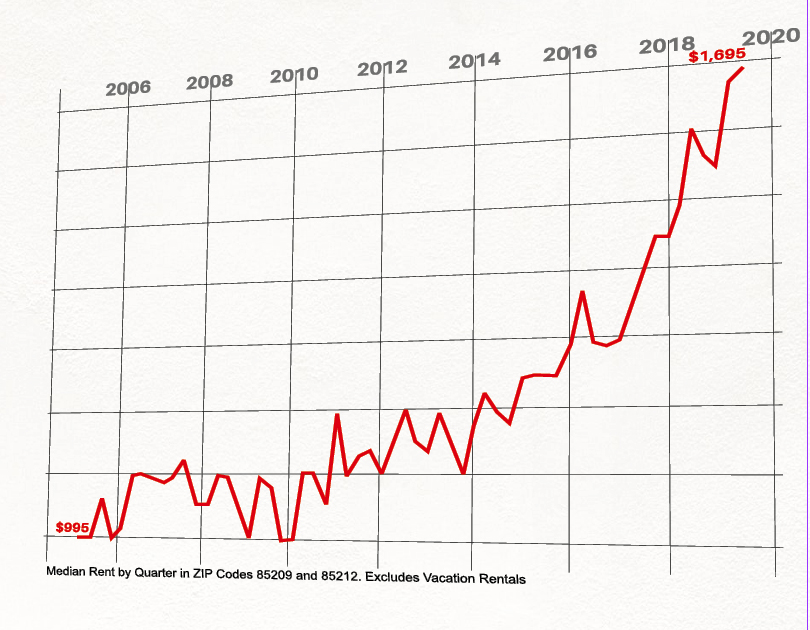

Arizona rents are on the rise. Over the past fifteen years, rents in 85209 have nearly doubled, but in a more recent spike in rents nationwide, rent increases in Phoenix Metro of 8.28% since the beginning of 2019 are outpacing the nationwide increase during the same time period of 3.8% as reported by the Consumer Price Index.

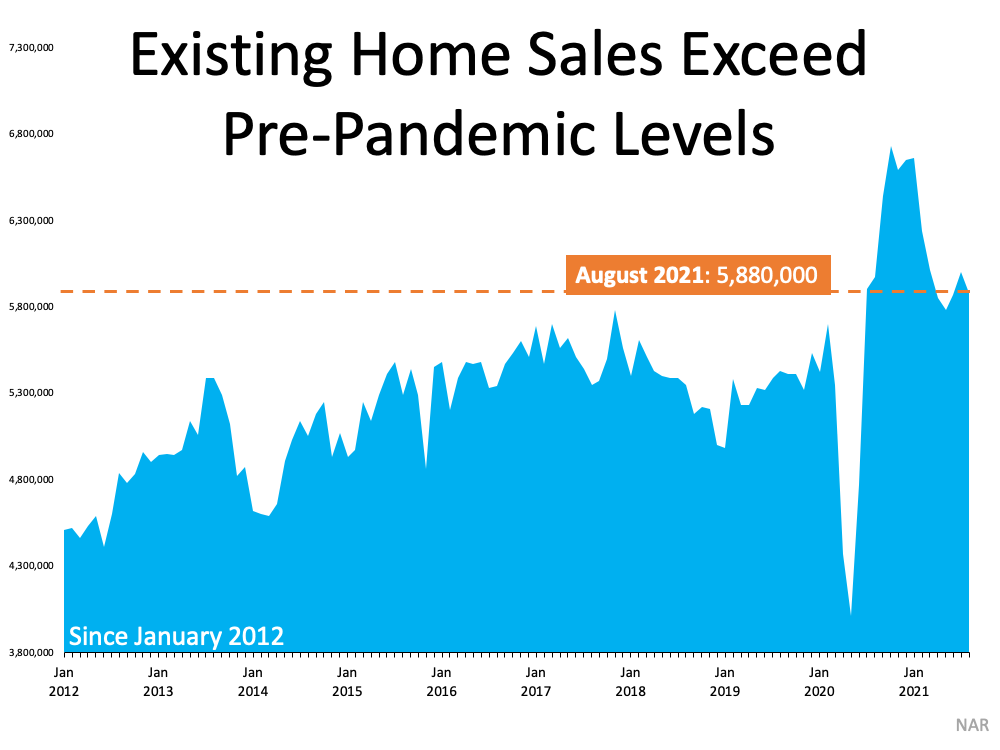

Phoenix Metro and Las Vegas have been trading spots as the #1 metro area in the United States for largest increase in rents, as both cities are seeing more renters.

Our community has numerous multifamily projects in the works, but with more people choosing to rent, a continued rise in rents is expected.

Many Millennials Choosing to Rent

Despite the spikes in rent costs, a recent survey from Freddie Mac showed a record 82% of renters think that renting is more affordable than owning.

“For millennials and many Gen Xers, buying a home is no longer just a decision based on housing and housing costs,” said Freddie Mac CEO David Brickman. “Increasing pressure from student loans and the rising cost of child care are having a significant impact.”

While the American dream to own a home still exists with most millennials, to many it has become a deferred dream due to student loans, lack of down payment, and delayed marriage.

Despite this generational trend, savvy millennials are taking advantage of the benefits of homeownership, especially the opportunity to fix housing costs.

Homeownership Fixes Housing Payments

While monthly rent prices in 85209 have nearly doubled over the past 15 years, a homeowner who secured a fixed mortgage 15 years ago is most likely paying the same monthly mortgage as they were in 2004.

Not only is the monthly payment staying the same, but a portion of each monthly payment is building equity in the home by paying down the original loan.

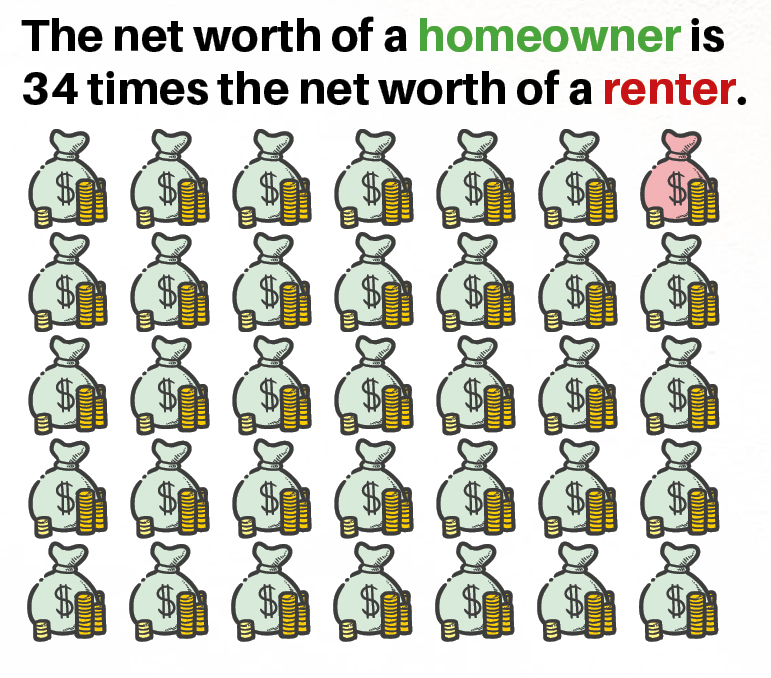

Because homeownership builds equity every month, homeowners are able to use their monthly housing costs as an investment, even if they’re unable to invest in other opportunities. As a result, the average net worth of a homeowner is 34 times that of a renter.

Homeownership is transformative. Research shows that homeowners not only have better health, they volunteer more, and their children have higher reading and math performance and are over four times more likely to stay in school.

Homeowners also enjoy additional tax benefits for interest expense and, unlike other investments, can exclude some of the capital gains on home appreciation.

“When you own your home, the mortgage interest and property taxes you pay are tax deductible and could provide tax benefit,” said CPA Mark Weech of Weech Financial. “On the other hand, any rent you pay has no possible tax benefit.”

It’s Not As Expensive as Many Think

44% of Americans believe you need a down payment of 20% or more to buy a home, and a similar 44% of Americans who don’t own say that the major stumbling block is the lack of down payment savings.

“It amazes me that 4 or 5 out of 10 people think you need a down payment of 20% or more when that’s not the case,” said Steve Farrington, a loan expert with loanDepot. “Conventional loan programs allow for as little as 3% down and FHA programs allow for 3.5% down. Other programs requiring no money for down payments such as VA and local downpayment assistance programs exist.”

In July 2019, HousingWire.com reported that the average down payment nationally is 5.3% of the purchase price, while Arizona averages much higher at 15.78% due to our lower prices versus other states.

Those making the transition from rent to buying are often surprised at how affortable it is. With the average 85209 rent of $1,600, a homebuyer with a 4% loan and $13,500 down could expect to be able to purchase a home at $270,000 and keep their monthly payment the same while enjoying all of the benefits of homeownership.

Don’t downplay the downpayment…

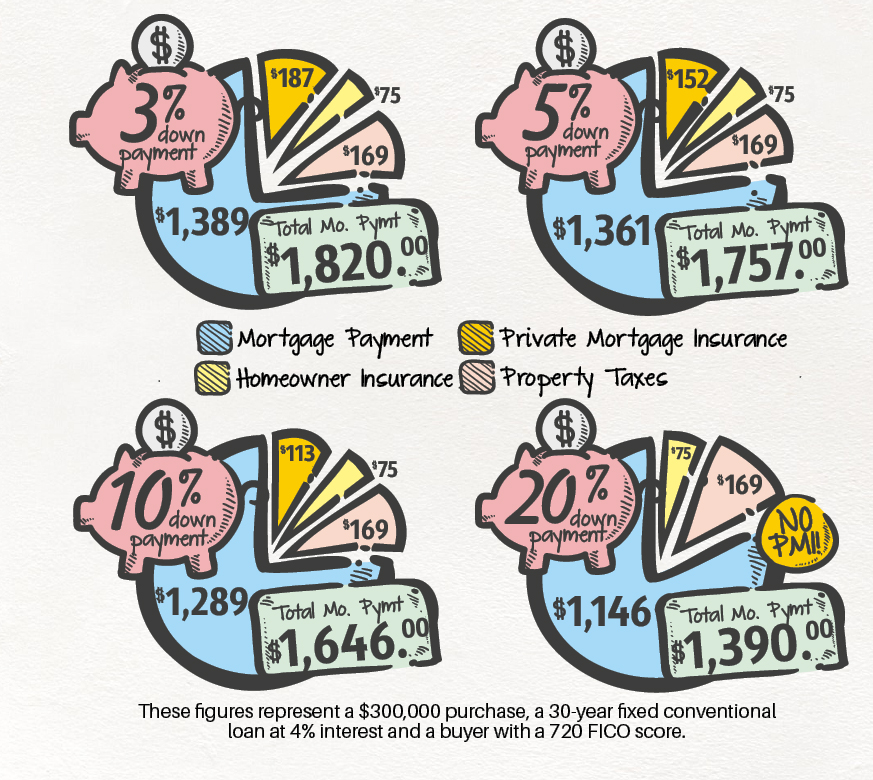

The downpayment can make a big difference over the long-haul. For loans of 80% or more of the value of the home, borrowers need to pay for a Private Mortgage Insurance (PMI) policy as a part of their monthly mortgage payment.

A borrower’s payment will generally be a PITI payment – Principal, Interest, Taxes, and Insurance, as the lender will pay the taxes and insurance on the borrower’s behalf. With a downpayment of 20%, there is no PMI, bringing the cost of the monthly mortgage payment down significantly.

The larger the initial investment, the lower the payment is over the life of the loan.

For those who want to investigate options, they can call the Klaus Team experts at 480-354-7344 or search local real estate real-time at klausteam.com.