With fewer homes on the market but with demand above normal, the market is hot and unbalanced in favor of sellers.

There are far fewer homes on the market in Phoenix metro than what has been historically normal, but sales per year remain above normal, putting the market more in favor of sellers.

“Our July inventory in 85209 was less than a month supply, and historically anything under 3 months supply is considered a seller’s market,” said Kraig Klaus, Listing Specialist on the Klaus Team. “It was 1.4 month supply in August 2018 and 1.9 month supply in August 2017.”

Typically, the normal level of active listings in all of Phoenix Metro is at 29,500, but we currently have less than 14,000 active listings. As a result, there are far fewer options for buyers, especially in the under $400,000 market, where there are more properties under contract than there are active for sale.

Buyer activity has remained high, however. While supply is 14% lower than last August, contracts in escrow are 15.5% higher than this time last year.

“The last two months have seen supply drop sharply from its already low level, so we now have a wholly inadequate number of homes for sale to keep the market funtioning normally” said Mike Orr, director of Cromford Associates and former director of the Center for Real Estate Theory and Practice at WP Carey School of Business at Arizona State University.

July was the lowest month for new listings hitting the market since Orr kept records, even though there are 63% more homes and the population is 50% larger.

“With new listings at a low ebb and closings at a high,” said Orr, “this is the most unbalanced market we have seen in favor of sellers since 2005. Given the massive increase in housing stock since 2001, it is amazing that we have fewer new listings in 2019 than in 2001.”

Pricing has not made a significant move yet, as pricing is a trailing indicator of a market shift. Orr notes that pricing often trails as much as 12 months behind other leading indicators.

Appraisers are also remaining very conservative. With 80% of buyers today requiring a loan, appreciation is not climbing as fast as it did the last time that inventory and demand were this unbalanced.

“This is the most unbalanced market we have seen in favor of sellers since 2005.”

Mike Orr, Cromford and Associates LLC Homeowners who want to wait to see prices climb, or to wait past the slower hot summer months may want to reconsider, however, as any projections of pricing changes in the market depend on what the future holds.

Homes are moving. “The listing success rate, which is the percentage of listings that closed with a sale versus those that expire or are cancelled, is currently 97% compared to 88% last month and 89% this time last year,” said Klaus.

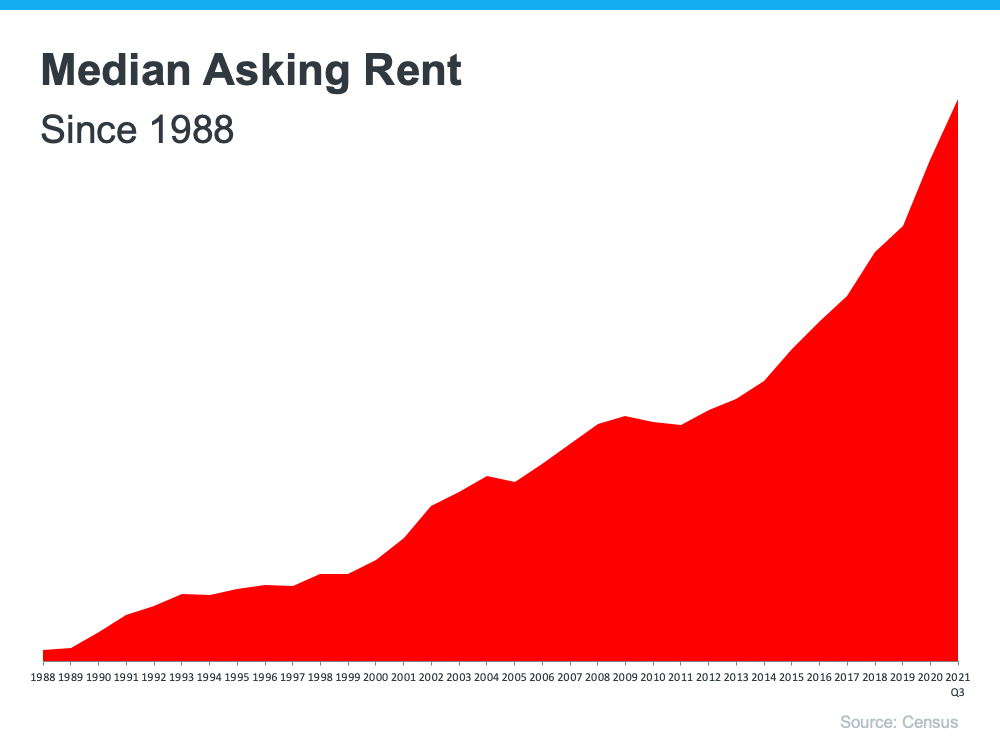

With lower interest rates and skyrocketing rents, many expect demand to continue to be high. Should sellers decide to take advantage of higher demand and there is an increase in supply, prices as a trailing indicator may not see more rise than what we’ve come to expect from normal market appreciation.

“All of this means that now is a great time to participate in this amazing Real Estate market,” said Klaus. “As we all know, we live in a very desirable area with great freeway access, increasing shopping options, and all the new tech and other businesses coming into the area so it will continue to be a very popular area in the valley for residents to call home.”

The rental market is very hot, which is causing a shortage in available homes for rent as well. With lower rates, forward-thinking homeowners are opting to become investors by using the equity in their homes to purchase a second home to use as a rental.

“Low inventory, high demand and low mortgage rates combined with our fantastic location and communities continue to make 85209 a great place to live and own a home – or homes.,” said Klaus.

“We’d love to help you make the best informed decision for your family,” said Klaus. “Best of all , you can have the Klaus Team on your side advocating and protecting your investment.”

For a free consultation to discuss all the opportunities available in this market including buying, selling, or investing, contact Kraig Klaus at 480.354.7344 or email kraig@klausteam.com.