You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home. And while that may be true in some markets if you just look at typical monthly payments, there’s one thing that the numbers aren’t factoring in: and that’s home equity. Here’s a look at how big of an impact equity can have and why it’s worth considering as you make your decision.

What the Headlines Are Based on

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, especially if you’re not looking for a lot of space, it can be more affordable on a monthly basis to rent:

But if you’re looking for something with 2 bedrooms, the gap between the median rent and the median mortgage payment starts to shrink to a difference that may be more doable. The median monthly mortgage payment is $2,040. The median monthly rent for 2 bedrooms is $1,889. That’s a difference of about $151 a month. But here’s what happens when you factor in equity too.

How Equity Changes the Game

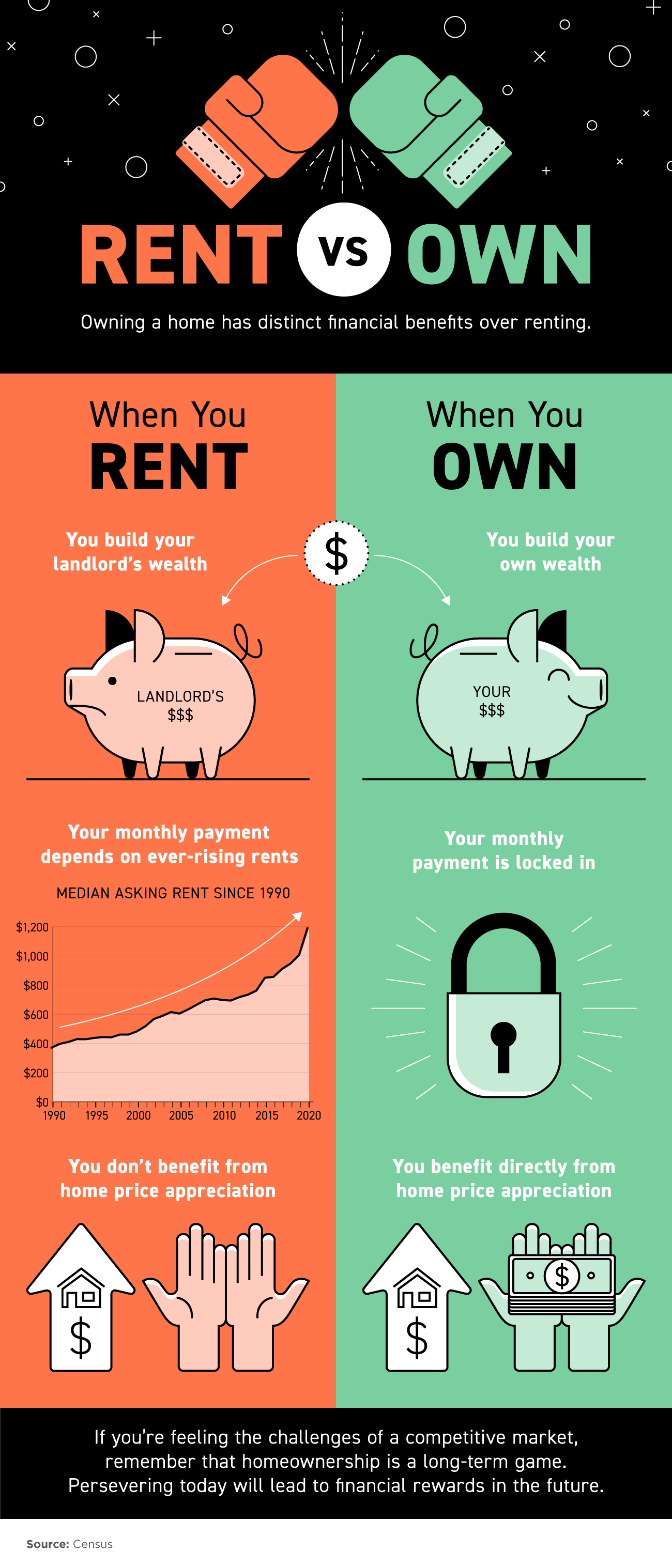

If you rent, your monthly rental payments only go toward covering your housing costs and your landlord’s expenses. So other than saving a bit more per month and maybe getting your rental deposit back when you move, the money you spent on housing each month is gone – forever.

When you buy, your monthly mortgage payment pays for your shelter, but it also acts as an investment. That investment grows in the form of equity as you make your mortgage payment each month and chip away at what you owe on your home loan. Your equity gets an extra boost as home values climb – which they typically do.

To give you a clearer idea of how equity can really stack up fast, here’s some data for you. Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 economists, real estate professionals, and investment and market strategists what they think will happen with home prices. In the latest release, those experts say home prices are going to keep going up over the next five years.

Here’s an example of how equity builds based on the projections from the HPES (see graph below):

Imagine you purchased a home for $400,000 at the start of this year. Chances are, since you bought, you plan to stay put for a while. Based on the HPES projections, if you live there for 5 years, you could end up gaining over $83,000 in household wealth as your home grows in value.

Here’s how that stacks up compared to renting, using the overall median rent from above:

While you may save a bit on your monthly payments if you rent right now, you’ll also miss out on gaining equity.

So, what’s the big takeaway? Whether it makes more sense to rent or buy is going to vary based on your personal finances. It’s not a good idea to buy if the numbers truly don’t work for you. But, if you’re ready and able, adding equity as the final puzzle piece may be enough to help you realize buying is a better move in the long run.

Bottom Line

When it comes down to it, buying a home gives you a benefit renting just can’t provide – and that’s the chance to gain equity. If you want to take advantage of long-term home price appreciation, talk to a local real estate agent to go over your options.